6 E-Statement Benefits You’ll Want to Know

If you’ve been thinking about signing up for electronic bank statements (e-statements), now’s the time to opt-in — because you’re not going to want to miss out on these e-statement benefits! Technology is better. Security and digital privacy have increased. Don’t even get us started on new apps with better features!

Why start receiving e-statements now? A lot of financial institutions have started offering incentives to those who make the switch. And, if you’re a First New York Federal Credit Union member, this includes you, as well!

Here, are the six main reasons why you should start enrolling in e-statements. Because who doesn’t like additional advantages?

Six E-Statement Benefits

Enrolling in e-statements doesn’t just mean you’re going paperless with electronic bank statements. There’s so much more to it. Check out the six e-statement benefits!

1. Additional Incentives

Many banks and credit card companies are happy to share exclusive incentives with people who opt into digital services. For example, First New York Federal Credit Union (FCU) has a special program for First New York e-members.

First New York FCU e-members are credit union members who are enrolled and use certain digital banking services. One of those services is being enrolled in e-statements. That’s just our credit union’s perks provided. Some additional incentives offered by other institutions can include lower rates, lower to no fees, and promotions.

2. Simple Sign Up

Right now, financial institutions are making it easy for you to switch to e-statements. For instance, First New York makes it easy for you to sign up on our two digital platforms, First OnLine or FNY On-The-Go, in less than six steps. Check out our “Go Paperless Electronic Bank Statements” guide to set up your e-statements.

You can also either text or call (518) 393-1326 to get assistance enrolling in e-statements from a local First New York Member Service Specialist!

3. Immediate Availability

Say goodbye to waiting for your account statements in the mail. With e-statements, your statement is ready once they’re processed, so you no longer have to wait up to a week or more to receive them. This can give you some extra time in case you see suspicious activity on your account (like an unknown transaction) or have a question you need assistance with.

4. Constant and Convenient Access

Are you someone who put their mailed statements in a drawer or filing cabinet? You can reduce clutter in your home with e-statements. All of your information is stored in your bank’s online or mobile application. You can easily access your statements through internet access without the paper trail.

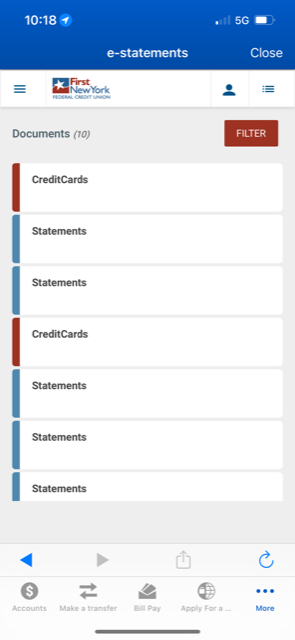

So, if you’re away from home and need to see your statement, you don’t have to worry about your personal information lingering in the mail for people to try to take for identity theft. Instead, you can protect your information and view your statements from your online banking platform. Here’s an example of what e-statements look like in the FNY On-The-Go app through your online account.

5. Eco-Friendly

Imagine all the paper, gas, and water you could save by choosing not to get paper statements. You’re saving trees and water for the creation of the paper. You’re also saving the gas needed to ship the paper statement.

And, you may not even know it, but your financial institution could be charging you a fee for them to be printed and mailed!

According to American National Bank & Trust, “You can save up to $36 dollars a year by choosing e-statements and avoid the $3 paper statement fee associated with many accounts.”

So, by enrolling in e-statements, you could save energy and money. Now, that’s a win-win!

6. Secure Delivery

Mail fraud is a serious crime. It’s an easy way for people to steal your personal or sensitive information. If you’re mailing your bank statements, this could be an easy way for someone to get a hold of your bank account information and history. People can also get a hold of your old account statements if you don’t shred them properly when you’re disposing of them.

A better solution is to receive them digitally through your financial institution’s secure platform. Their delivery and storage are secure. So, you don’t have to worry about someone obtaining it by going through your mail, digging through your file cabinets, or rummaging through your garbage.

No Comments